A salary slip is a vital document provided by employers to employees, detailing the breakdown of the salary earned over a specific period. various official purposes like loans, tax filings, and employment verification. In this guide, we will explore a simple salary slip format in Word, offering a detailed view of its structure, how to use it effectively, and variations like salary slips for teachers.

What is a Salary Slip?

A salary slip (also known as a pay slip) is a document that provides detailed information about an employee’s earnings and deductions for a specific period. The slip typically includes details such as the employee’s name, designation, earnings, and deductions. It may also feature other relevant information like tax deductions, bonuses, and overtime pay.

Importance of a Salary Slip

Salary slips are important for multiple reasons:

- Proof of Income: Employees often need salary slips for loan applications, visa processing, and tax filings.

- Record Keeping: Both employers and employees can maintain salary slips for auditing and financial record-keeping purposes.

- Legal Requirement: In many regions, salary slips are legally required to ensure transparency in payroll processes.

Simple Salary Slip Format in Word

Creating a salary slip in Microsoft Word is a straightforward process. Below is a breakdown of the essential components of a simple salary slip format in Word:

Basic Structure

Here is a simple salary slip format that can be customized based on specific requirements:

1. Header Section:

- Company Logo: At the top of the slip, you can add the company’s logo and name.

- Employee Information: Include the employee’s name, designation, and employee ID. Example:

- Employee Name: John Doe

- Employee ID: 12345

- Designation: Software Engineer

- Department: IT

2. Salary Breakdown Table:

| Component | Amount |

|---|---|

| Basic Salary | $2,500 |

| House Rent Allowance (HRA) | $1,000 |

| Special Allowance | $500 |

| Overtime Pay | $200 |

| Bonus | $300 |

| Gross Salary | $4,500 |

| Deductions | -$400 |

| Net Salary | $4,100 |

3. Deductions:

- Provident Fund (PF): A standard deduction in many countries for employee retirement savings.

- Tax Deduction at Source (TDS): Government tax deductions based on the employee’s income.

- Insurance Premiums: Deductions for any health or life insurance policies taken by the company.

- Other Deductions: Any additional deductions based on company policies.

4. Footer Section:

- Payment Mode: Whether the salary is paid via cheque, bank transfer, or cash.

- Salary Payment Date: The date the salary is credited to the employee’s account.

- Authorized Signatory: Space for the signature of the authorized company representative.

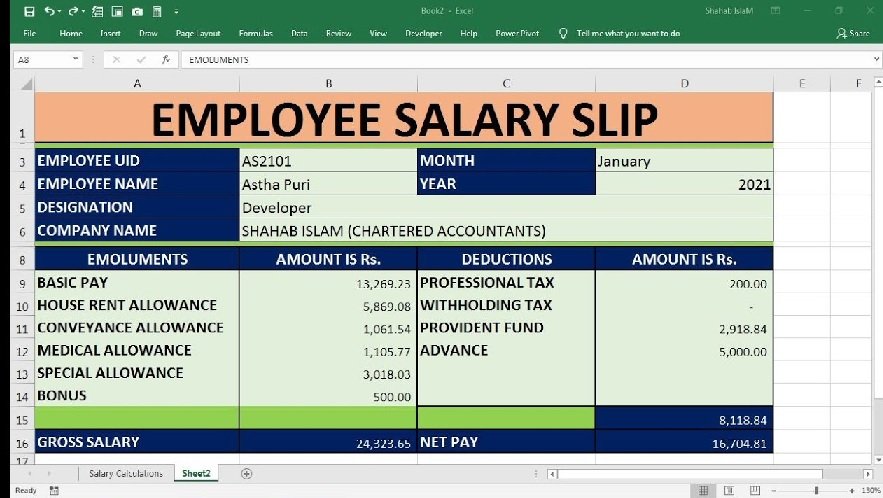

Simple Salary Slip Format in Excel

While Microsoft Word is a common tool for creating salary slips, Excel offers the added benefit of calculations and easy-to-use formulas. Here’s a brief guide on a simple salary slip format in Excel.

Why Use Excel for Salary Slips?

- Automation: Excel allows you to automate calculations for gross salary, tax deductions, and net salary.

- Customizable: You can add additional columns or modify existing ones based on your company’s policies.

- Ease of Use: Excel has built-in functions for adding or subtracting values, which simplifies the process for salary calculations.

Sample Simple Salary Slip Format in Excel

| Component | Amount (in $) |

|---|---|

| Employee Name | John Doe |

| Employee ID | 12345 |

| Designation | Software Engineer |

| Basic Salary | 2,500 |

| House Rent Allowance | 1,000 |

| Special Allowance | 500 |

| Overtime Pay | 200 |

| Bonus | 300 |

| Gross Salary | =SUM(B5:B9) |

| Provident Fund (PF) | 250 |

| Tax Deduction | 100 |

| Other Deductions | 50 |

| Total Deductions | =SUM(B11:B13) |

| Net Salary | =B10-B14 |

Simple Salary Slip Format in Word for Teachers

Teachers also require a salary slip that outlines their earnings and deductions clearly. A simple salary slip format for teachers follows a similar structure to the general format, but there are some differences depending on the educational institution’s policies.

Example of Simple Salary Slip Format for Teachers

| Component | Amount |

|---|---|

| Employee Name | Ms. Sarah |

| Employee ID | T23456 |

| Designation | Teacher |

| Basic Salary | $2,000 |

| House Rent Allowance | $800 |

| Special Allowance | $400 |

| Overtime Pay | $100 |

| Gross Salary | $3,300 |

| Deductions | -$300 |

| Net Salary | $3,000 |

Teachers may also have specific allowances, such as book allowances, education allowances, or research allowances, which can be added to the slip.

Common Deductions for Teachers:

- Provident Fund (PF)

- Tax Deduction at Source (TDS)

- Insurance Premiums

Customizing Salary Slip Formats for Different Sectors

The salary slip format can be customized for various sectors. For example, while teachers might receive specific allowances for teaching materials or research, employees in the corporate sector might have bonuses, commissions, or stock options.

Key Elements for Customization:

- Basic Salary: This is the fixed amount paid to an employee.

- Allowances: Include housing, transport, education, or any sector-specific allowances.

- Deductions: Include taxes, loans, provident fund contributions, etc.

- Gross and Net Salary: Gross salary is the total before deductions, while net salary is the amount paid to the employee after deductions.

Conclusion

Creating a simple salary slip in Word or Excel is a convenient way to ensure transparency in the payroll process. By using these formats, companies can provide their employees with clear, concise documentation of their earnings and deductions. Customizing salary slips based on the nature of employment, such as for teachers or corporate employees, ensures accuracy and relevancy.

Whether you use Word or Excel, both tools offer excellent ways to manage salary slips, making it easier for employers to keep track of their payroll system while providing employees with the necessary documentation.